Buy verified Venmo accounts: The Growing Need for Verified Venmo Accounts

Venmo has become one of the most widely used peer-to-peer payment systems in the United States. It allows users to transfer money to friends, family, and businesses with just a few taps on their smartphones. While its initial purpose was for personal use, Venmo has grown to play a crucial role in business transactions, especially for freelancers, small businesses, and online sellers. As the platform has evolved, so too has the demand for verified Venmo accounts.

A verified Venmo account offers users a variety of benefits, from higher transaction limits to enhanced security features. However, obtaining a verified Venmo account can take time, requiring users to go through a lengthy verification process. This has led some individuals and businesses to seek a quicker route: buy verified Venmo accounts.

This article will delve into the practice of buying verified Venmo accounts, exploring its benefits, risks, legal and ethical considerations, and how to go about purchasing an account safely. Additionally, we’ll discuss the future of verified accounts on Venmo and alternatives to buying accounts.

What Are Verified Venmo Accounts?

A verified Venmo account is one that has gone through Venmo’s official identity verification process. Venmo requires users to provide personal details, such as their full name, Social Security number, date of birth, and linked bank accounts, before their accounts can be considered verified. The verification process ensures that users are who they say they are and helps prevent fraud and identity theft.

The Verification Process

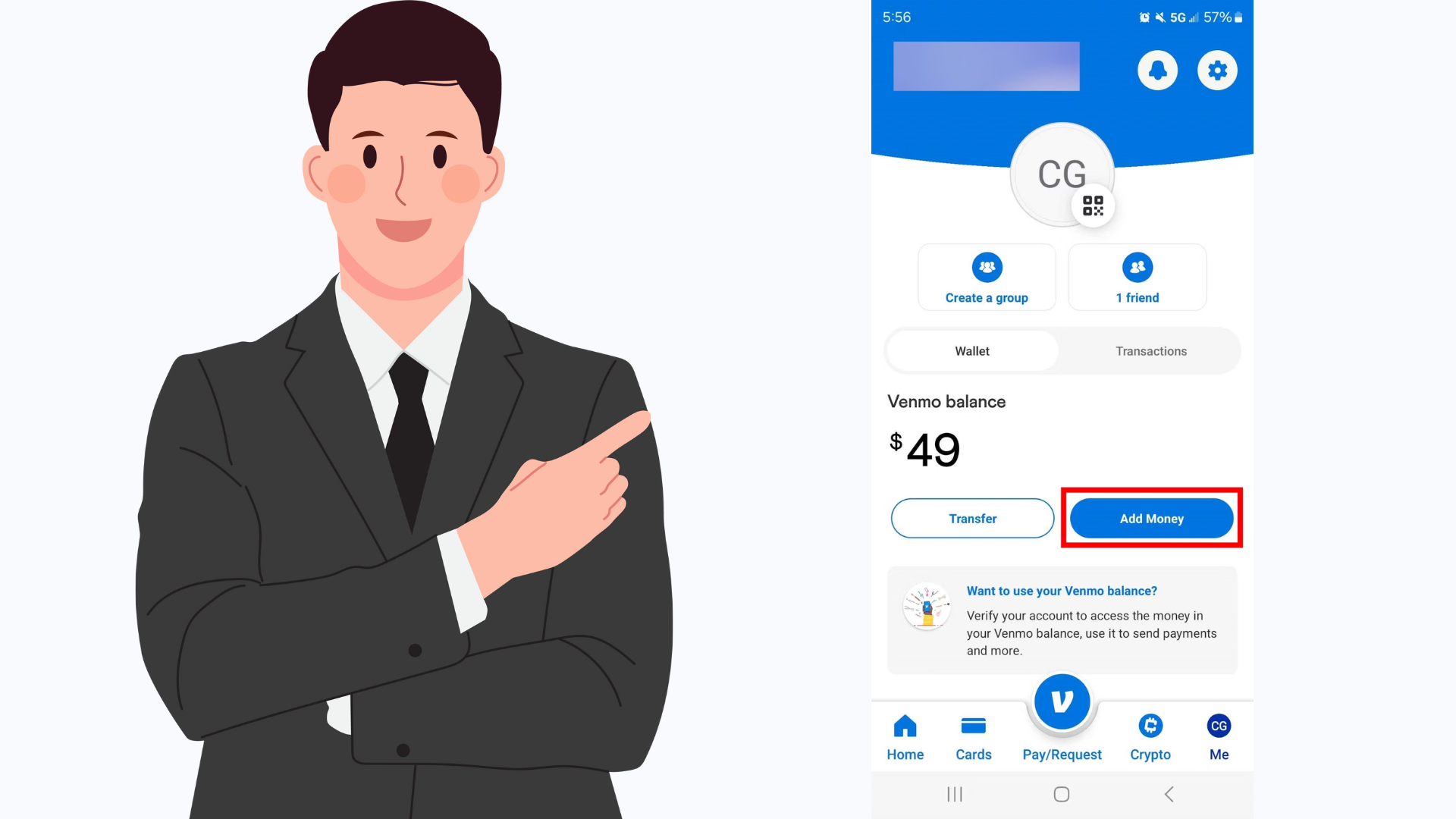

To get a verified Venmo account, users must go through a step-by-step process that includes the submission of key identifying documents, such as a government-issued ID. Venmo also requires users to link a bank account or debit/credit card to their profile, ensuring that transactions are legitimate and traceable.

Venmo’s verification process is part of the company’s efforts to comply with financial regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. This process ensures that Venmo users are properly identified, reducing the risk of fraudulent activities, and allowing for larger transactions.

Benefits of a Verified Venmo Account

A verified Venmo account comes with several advantages, which is why many users and businesses opt for the verification process:

- Higher Transaction Limits: Verified users can send and receive up to $60,000 per week for business transactions, a significant increase compared to the $299.99 per week limit for non-verified users.

- Enhanced Security: The verification process includes security checks that protect users from fraud and unauthorized transactions. Verified accounts are less likely to be flagged for suspicious activity.

- Trust and Credibility: For businesses and freelancers, a verified Venmo account builds trust with clients and customers. It shows that you are a legitimate and reliable entity, which can improve your reputation.

Why People Choose to Buy Verified Venmo Accounts

For some users, the process of getting a verified Venmo account can be a deterrent. Verification typically requires submitting personal information and waiting for approval, which can take several days. This delay can be frustrating, especially for users who need to send or receive large sums of money quickly. As a result, many people opt to buy verified Venmo accounts.

Convenience and Time-Saving

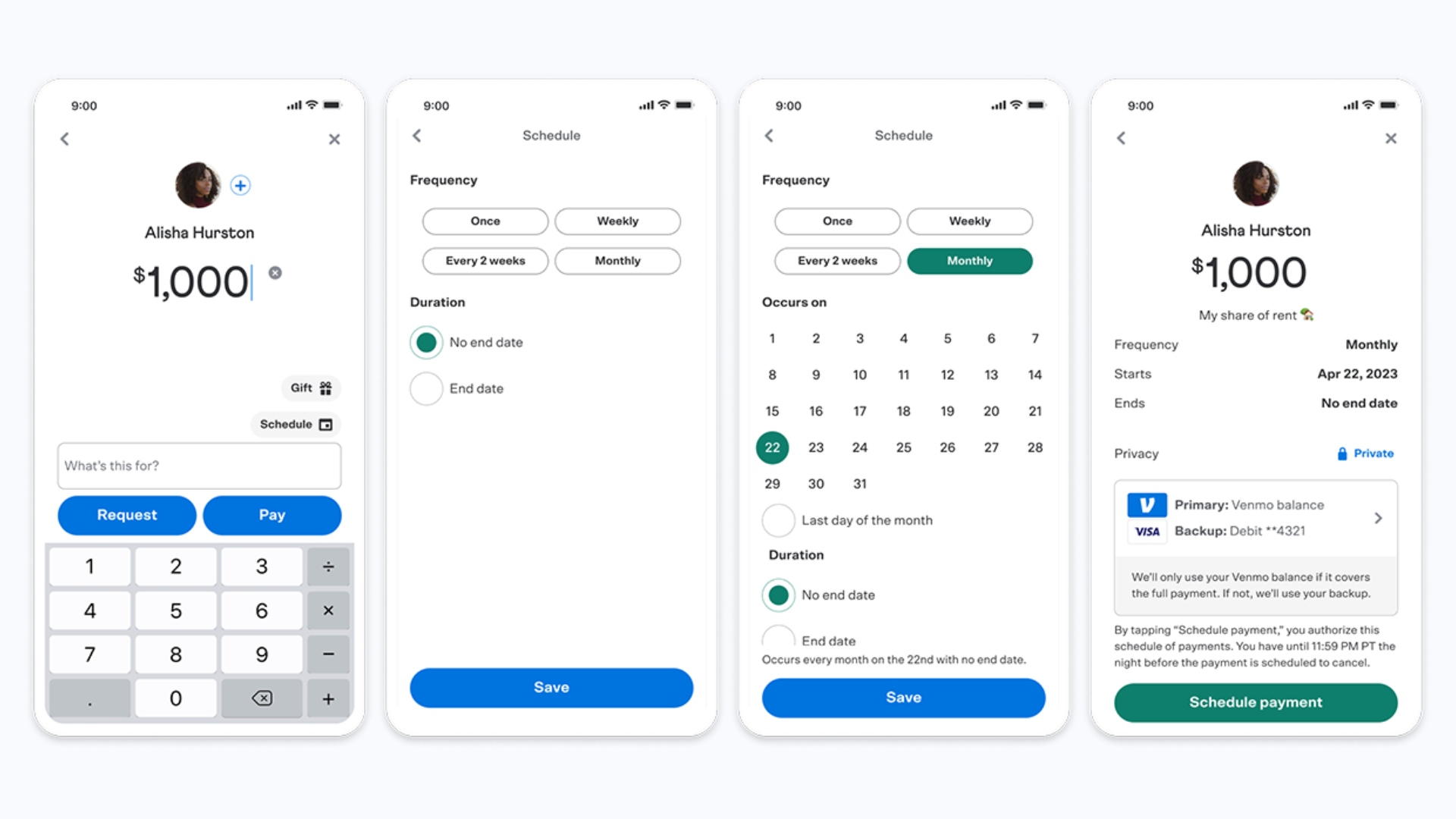

One of the main reasons people choose to buy verified Venmo accounts is the convenience. Users who need to bypass the lengthy verification process can simply purchase an account that has already gone through the process. This means they can start using their verified account right away without waiting for approval. This is particularly useful for businesses that need to receive payments from customers and clients as soon as possible.

Use Cases for Buying Verified Venmo Accounts

- Freelancers and Gig Workers: Freelancers often rely on platforms like Venmo to receive payments for their work. By purchasing a verified Venmo account, they can start receiving larger payments without delay.

- Small Business Owners: Small business owners, especially those in e-commerce or service industries, find it beneficial to buy verified Venmo accounts to help them process payments quickly and securely.

Legal and Ethical Considerations in Buying Verified Venmo Accounts

While the practice of buying verified Venmo accounts might seem like a quick and easy solution, it’s important to consider the legal and ethical implications before making a purchase. Venmo has strict terms and conditions regarding account ownership, transfer, and verification, and bypassing the official process could lead to various legal and financial consequences.

Venmo’s Terms of Service and Legal Framework

Venmo’s terms of service explicitly prohibit the buying, selling, or transferring of accounts. According to Venmo’s policies, account ownership should remain tied to the person who has completed the verification process. If Venmo detects any unauthorized transactions, such as the purchase or sale of an account, they may suspend or permanently ban the account.

For users considering whether to buy verified Venmo accounts, it’s crucial to understand that Venmo reserves the right to terminate any account that violates their terms. This could result in not only the loss of the purchased account but also potential legal action for fraudulent activities.

Consequences of Violating Venmo’s Terms

Purchasing or transferring a verified Venmo account is considered a violation of Venmo’s terms of service. Users found in violation of these terms could face account suspension, freezing of funds, and in some cases, legal penalties depending on the severity of the violation. Venmo can also report violations to regulatory authorities, which could result in fines or other legal consequences.

In addition, Venmo’s security protocols are designed to detect unauthorized account transfers. Even if a verified Venmo account is purchased legitimately, the platform may flag the account for suspicious activity if it detects a change in ownership. This could lead to a temporary or permanent freeze on funds, leaving the buyer with limited access to their money.

Ethics of Buying Verified Venmo Accounts

Beyond the legal implications, the ethics of buying verified Venmo accounts must also be considered. Bypassing the verification process raises concerns about fairness and trust within the Venmo platform. For many users, verification is a key element in ensuring the integrity of the payment system. By purchasing a verified account, users might be seen as circumventing the process, potentially undermining the system’s overall credibility.

Ethically, it’s important to recognize that the practice of purchasing accounts could give an unfair advantage to certain individuals or businesses. For example, businesses that need to process high-volume payments might use a purchased verified Venmo account to avoid the usual delays in getting verified themselves, thus gaining an edge over others who follow the standard process.

How to Safely Buy Verified Venmo Accounts

If you’re considering buying verified Venmo accounts, it’s essential to take the right precautions to ensure that the account you’re purchasing is legitimate and secure. The process of acquiring a verified Venmo account can carry risks, but by following specific steps, you can minimize potential issues and protect your investment.

Step-by-Step Guide to Buying Verified Venmo Accounts

- Do Thorough Research: Before deciding to buy verified Venmo accounts, make sure to research the seller thoroughly. Look for trusted marketplaces or reputable third-party services that specialize in selling legitimate accounts. Sellers with solid reviews and feedback from previous buyers are a good sign.

- Verify the Account’s Authenticity: When you decide to buy verified Venmo accounts, it’s important to verify the authenticity of the account. Check the account’s transaction history, ensuring there are no red flags or signs of previous violations. Ask for documentation, such as a government-issued ID or proof of verification, to ensure the account has passed all necessary checks.

- Request Proof of Verification: Always request specific proof of verification before you buy verified Venmo accounts. This could include screenshots of the account showing the verified status or documents verifying the seller’s information.

- Use Secure Payment Methods: When you’re ready to buy verified Venmo accounts, always opt for secure payment methods. Avoid transferring money directly via Venmo or wire transfer without protection. Using trusted third-party payment services or escrow services is an excellent way to ensure that the transaction is secure for both parties.

- Confirm the Transfer of Ownership: Once you have successfully decided to buy verified Venmo accounts, ensure that the account transfer process is completed correctly. This means updating the account with your personal information, phone number, and bank details. Ensure that the original account’s details are completely removed from the profile to avoid future complications.

Red Flags to Watch Out For

When deciding to buy verified Venmo accounts, it’s crucial to stay vigilant and spot potential scams. Here are some red flags that should make you reconsider a transaction:

- Unrealistically Low Prices: If the price seems too good to be true, it usually is. Scammers often lure buyers with artificially low prices to entice them into transferring money quickly. Always be wary if the deal feels too cheap.

- No Proof of Verification: If the seller refuses or hesitates to show proof of verification, this is a clear red flag. A legitimate seller should be transparent about the account’s verified status.

- No Seller Reviews or Reputation: When you decide to buy verified Venmo accounts, check the seller’s reviews. If the seller has little or no reputation within the marketplace, this could indicate a scam. Always look for sellers with proven track records.

Post-Purchase Actions

Once you successfully buy verified Venmo accounts, it’s vital to take steps to protect your account and ensure it’s secure:

- Update Your Personal Information: Immediately after you buy verified Venmo accounts, update the account with your personal information, such as linking it to your own phone number, email, and bank accounts. This will prevent any confusion or issues with ownership.

- Enable Two-Factor Authentication (2FA): For extra protection, set up two-factor authentication (2FA) to prevent unauthorized access to your account. This step adds another layer of security and ensures that only you can access the account.

- Monitor Account Activity: Regularly monitor your verified Venmo account for unusual or unauthorized transactions. If anything suspicious happens, report it to Venmo immediately. Vigilance is key in maintaining the safety of your account.

Risks and Challenges of Using Verified Venmo Accounts

While the idea of buying verified Venmo accounts might seem attractive, it’s essential to weigh the risks and challenges involved. The convenience of buying verified Venmo accounts often comes with consequences that can affect the long-term use of the account.

Account Ownership Transfer Issues

One significant risk associated with deciding to buy verified Venmo accounts is the potential for issues surrounding the transfer of ownership. Venmo’s system is designed to monitor account ownership and detect any changes. If the account ownership is transferred, Venmo may flag the account for suspicious activity.

In such cases, Venmo could freeze or temporarily suspend the account while investigating the ownership change. This means that even if you successfully buy verified Venmo accounts, your funds might be held up, causing delays in processing payments or receiving funds. These issues could be frustrating and could result in the loss of access to your money.

Security and Privacy Concerns

When you decide to buy verified Venmo accounts, security becomes a top concern. If the account you purchase was previously compromised or used for fraudulent activity, you could be at risk of identity theft or fraud. Even after successfully purchasing the account, malicious actors could attempt to access your account information, putting your financial security in jeopardy.

Furthermore, the previous owner’s personal information may still be linked to the account. This could create privacy concerns, as sensitive data might still be accessible to anyone with the correct access.

Long-Term Viability of Purchased Accounts

One of the key considerations before choosing to buy verified Venmo accounts is the long-term viability of the account. Venmo’s security algorithms may detect the change in ownership and could suspend the account or cancel the verification status. Even if you update the account with your personal information, there is no guarantee that Venmo will accept the transfer without issues.

The viability of the account also depends on how closely the new owner’s details match the original verification information. Any discrepancies in the details could lead to the account being flagged or suspended, causing significant inconvenience for the buyer.

Alternatives to Buying Verified Venmo Accounts

If the risks of buying verified Venmo accounts seem too great, there are several alternatives worth considering. Here are some options to explore before you decide to buy:

Create Your Own Verified Venmo Account

One of the most straightforward alternatives to buying verified Venmo accounts is to simply go through Venmo’s official verification process. While it may take time, it ensures that you remain fully compliant with Venmo’s terms of service, avoiding potential penalties down the line.

Creating your own verified account allows you to maintain full control and ensures that your account remains secure, without the risks associated with purchasing an account from a third-party seller.

Use Other Payment Platforms

If Venmo doesn’t seem like the best fit, there are numerous other payment platforms to consider. For example:

- PayPal: PayPal offers similar peer-to-peer payment capabilities, often with better buyer protection features. Verified PayPal accounts can handle both personal and business transactions, similar to Venmo.

- Cash App: Another popular alternative, Cash App allows for instant money transfers and features a similar verification process to Venmo.

- Zelle: Zelle is often used for instant bank transfers, making it a great option for quick transactions without fees.

Exploring these alternatives might provide you with the same benefits without the need to buy verified Venmo accounts, especially for businesses or individuals who need fast access to their funds.

The Future of Verified Venmo Accounts and Digital Payments

As digital payment systems continue to evolve, Venmo remains a central player in the world of online money transfers. However, with the ever-growing demand for digital transactions, the future of verified Venmo accounts will likely experience significant changes, both in terms of the platform’s features and its policies.

Emerging Trends in Digital Payments

One of the most significant trends in the digital payments space is the rapid adoption of cryptocurrency and blockchain technology. As Venmo explores the possibility of integrating cryptocurrency into its platform, the verification process could evolve as well. This shift may require even more stringent identity verification procedures to ensure the security and legitimacy of transactions.

With the rise of digital currencies, Venmo might introduce new ways for users to buy, sell, and store digital assets, further broadening its scope beyond traditional peer-to-peer payments. This could make buying verified Venmo accounts even more appealing for users who wish to take advantage of these new opportunities, especially in the business sector.

Venmo’s Future Verification Process

Looking ahead, Venmo may strengthen its verification process as part of its ongoing commitment to security. Enhanced verification measures, such as biometric authentication or multi-factor authentication (MFA), could become standard for users seeking to create verified accounts. As part of an effort to mitigate fraud and identity theft, these added layers of security would likely make it more difficult for individuals to buy verified Venmo accounts from untrustworthy sources.

Venmo may also implement additional checks and balances to ensure that users who choose to buy verified Venmo accounts are doing so in compliance with platform policies. This could include integrating machine learning algorithms to detect unauthorized transactions or identity mismatches, preventing fraudulent activities.

Venmo’s Role in Global Digital Payments

As Venmo continues to expand its presence internationally, the demand for verified accounts may increase. In countries where Venmo is not yet widely available, users may want to take advantage of the ability to buy verified Venmo accounts as a way to access global markets and financial services. As digital payments become more globalized, Venmo may eventually develop cross-border capabilities, allowing users from different countries to seamlessly transfer funds to one another.

Conclusion

In conclusion, buying verified Venmo accounts offers both benefits and risks. While this method can provide instant access to higher transaction limits and enhanced security, it also comes with a significant set of challenges. From the potential for account suspensions to the ethical and legal implications of bypassing Venmo’s verification process, there are several factors to weigh before choosing to purchase a verified account.

For businesses and freelancers, the convenience of buying verified Venmo accounts might outweigh the risks, but it’s crucial to understand the potential consequences. By following the right precautions—such as verifying the account’s authenticity, using secure payment methods, and staying vigilant for signs of fraud—users can help mitigate the risks of buying a verified Venmo account.

For those who are not comfortable with the risks, creating a verified Venmo account through the official process remains the safest and most reliable option. As the digital payments landscape continues to evolve, Venmo’s role as a leading platform will likely adapt, and verified Venmo accounts will continue to be integral to ensuring security and legitimacy in online transactions.

FAQs

How Can I Ensure a Verified Venmo Account Is Legitimate Before Buying?

When you decide to buy verified Venmo accounts, always ask the seller for proof of verification. This could include screenshots of the verified status or documentation confirming the account’s legitimacy. Be sure to also verify the account’s transaction history and check for any signs of suspicious activity.

Can Venmo Penalize Me for Using a Purchased Verified Account?

Yes, if Venmo detects that an account has been purchased or transferred, it may suspend or permanently ban the account for violating its terms of service. It is essential to understand the risks involved before deciding to buy verified Venmo accounts.

What Are the Risks of Buying Verified Venmo Accounts for My Business?

Businesses that decide to buy verified Venmo accounts may face potential issues with account suspension, fraud, or data breaches. It’s essential to ensure that the account is properly transferred and updated with your details to avoid any disruptions in payment processing.

Are There Safer Alternatives to Buying Verified Venmo Accounts?

If you want to avoid the risks of purchasing a verified account, consider going through Venmo’s official verification process. Alternatively, you can explore other digital payment platforms like PayPal, Zelle, or Cash App, which may offer similar features without the need to buy verified Venmo accounts.

Appendices

Legal Resources

- Link to Venmo’s official Terms of Service for a full understanding of their policies on account ownership and verification processes.

- Legal articles on the implications of purchasing or transferring digital payment accounts.

Glossary of Terms

- Verified Venmo Account: An account that has passed Venmo’s identity verification process.

- KYC (Know Your Customer): A regulatory process that requires financial institutions to verify the identity of their customers.

- Multi-Factor Authentication (MFA): A security process that requires more than one method of verification to access an account.

Reviews

There are no reviews yet.